In trading everything is about chance and risk. If you open a trade, you have a chance to lose or win money. The most important question is: How much money do you win in relation to the planned loss? That’s the chance-risk-ratio.

First understand the chance-risk-ratio concept …

To identify low risk entry points you first have to understand the chance-risk-ratio. The concept is simple:

Possible profit / planned loss = chance-risk-ratio.

The possible profit is the money you will win if your trade works as expected. To get this number, you must subtract the target from your entry price. Example: $70 target – 50$ entry price = $20 profit.

The planned loss is the amount of money you are risking. It’s the difference between your entry price and stop loss. Example: $50 entry price – $45 stop loss = $5 planned loss or risk.

Now you have all you need. Here is your chance-risk-ratio:

$20 profit / $5 planned loss = 4.

If your trade reached the target, the return will be 4 times of your initial risk. That’s a good chance-risk-ratio.

Why is the chance-risk-ratio important?

You should only risk money if it’s attractive. Don’t place bets where you only get a small return. Of course it depends on the hit-rate but you want to calculate for the worst case.

If your hit-rate decreases, you need a higher chance-risk-ratio. Because it’s very difficult to maintain a high hit-rate over time, you want to consider this. Try to reach higher chance-risk-ration instead of having a high hit-rate. Then you have build-in a buffer for failure.

What’s a good chance-risk-ratio?

That depends on you and your trading style. If you are a long-term trader, you often have a higher average chance-risk-ratio. If you are a short-term trader, you mostly have a lower average chance-risk-ratio and a higher hit-rate.

The same is true for trading styles. Trend followers often have a high chance-risk-ratio because they are following a trade for a longer time. A swing trader often has a lower chance-risk-ratio because he works with targets.

I personally don’t work with targets. Instead I apply a more trend following style. If a trade will return 3-5 times my initial risk, it’s a good trade. My best trades will return 10-20 times my initial risk.

Paul Tudor Jones famously said, that he will at least aim for a 5 times chance-risk-ratio.

What’s low risk entry point?

It’s simple: The smaller your planned loss or initial risk, the lower is the risk at the entry point.

Don’t think that a trade with a low risk entry point has a smaller risk to fail. That’s nonsense. In the short term every trade has the same odds: 50%. It can be a winner or loser. Only over a large number of trades you will generate a hit-rate and edge.

Focus on trades where you can place a stop loss very close to the entry point. That’s only possible if you select an entry where you see quickly if your trade works or not.

3 examples of different entry points

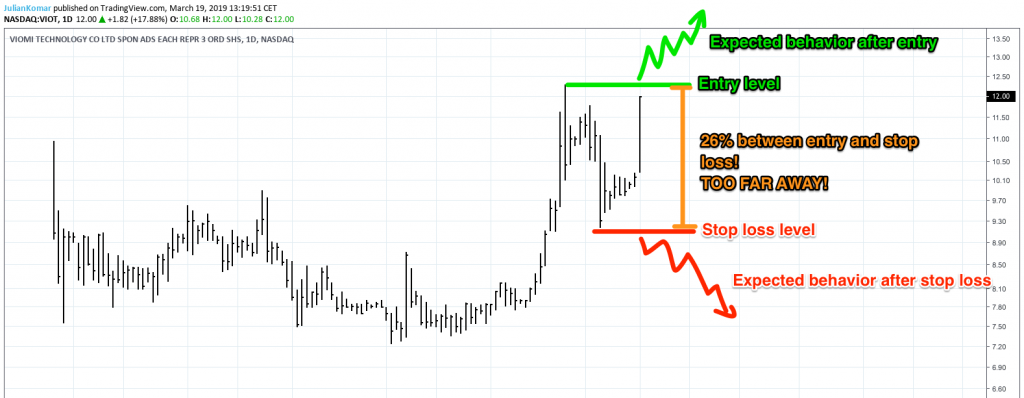

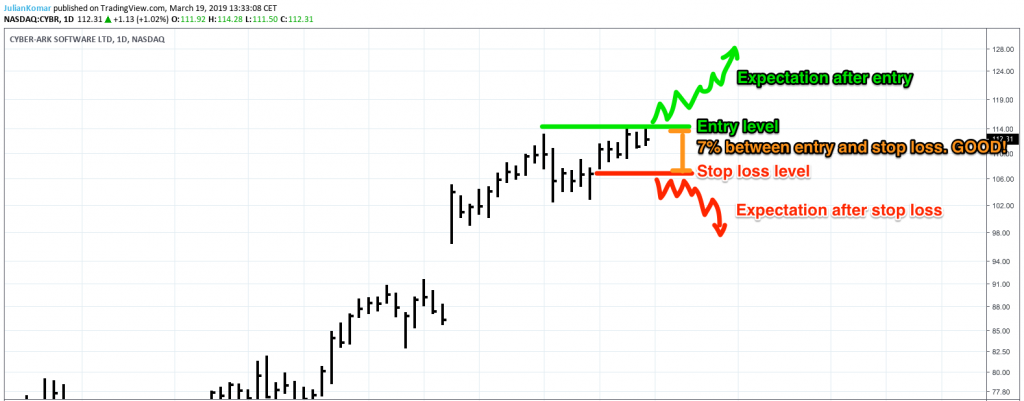

How to select a valid stop loss level?

I could write a whole own blog post about selecting stop loss levels. But remember: A stop loss level should be your insurance. It should show you clearly that the trade is not working and you have to exit immediately.

I personally only select trades where my stop loss level is less than 7% away. Often I exit a trade or sell a portion of my position at a drop of less than 5%.

If I select a good entry at the right time, the price will never come back to my entry price. Therefore something must be wrong if a stock drops 5-7% after my entry. I give enough room for daily fluctuations but not for corrections!

A simple and clear entry signal and a technical level close to the entry price are important. I mostly use simple chat patterns like flags, triangles or multiple tested resistance lines. For a stop loss I used the last low or a moving average like 10 or 20. That’s it.

If a trade is not working, you can’t do anything. Get out and try it again at a later point. The more important thing is that you have a close stop loss. If the trade is working instead, you have a great chance-risk-ratio.

A low risk entry point needs discipline

If you select a value for your maximum stop loss level, you created a rule. Every rule needs discipline to apply it. If you don’t do that, the rules is worthless.

I personally stick to my rules. I never open a position where the stop loss level is more than 7-10% away. 10% is the maximum I only allow for very volatile stocks. If a stop loss is more than 10% away I skip the trade and wait for a better entry.

A low risk entry will not help you if you don’t have sound rules to select great stocks. You need rules to select potential winners which will generate a good chance-risk-ratio. If you created you rules for a maximum stop loss level, you can start to optimize your selection criteria for stocks. That will increase you hit rate over time.

Thx. Very clear explanation.

any time you post youtube please you send it aslo can please send your watch list every week.

thank you

Nicely elaborated with simple words…. I loved reading…..