Trading and learning are two things which are connected very closely. Like in every other profession, you must always improve and get better. In my opinion this leads to true mastery.

If I talk to traders, I often hear that they have no diary, journal or any other notes. But why? Trading is not different to f.e. professionell sports, where they conduct post video-analysis and have many other tools. Or look at professionell cooks. They make notes all the time about new recipes and what was good or bad.

There is only one reason why some traders do not have any notes about their trading: They do not take it seriously.

I have 3 tools which helped me a lot to get more insight into my trading. They also helped me to improve and get better as a trader. Of course I reached not my final goal, but I am sure that I will do and the tools will help me.

The trading journal: Statistics and insight into your trading

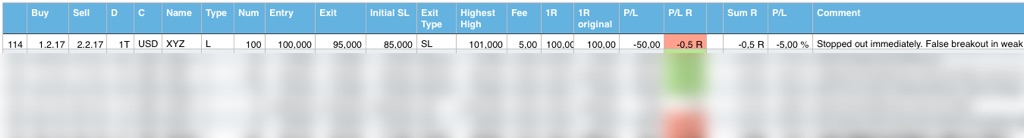

It is so simple: Collect every trade you made in a big spreadsheet. In addition you must collect every piece of information which can help you in future. The goal is to have data for a post analysis of your trading.

There is a reason why a lot of trader do not have a trading journal. It objectively confronts you with trading mistakes and your real outcome. If you produce multiple losses in a row you have to write down every trade and detail. But it will help you in the long-term to make progress and learn a lot about yourself.

Some data I collect in my trading journal

My trading journal is nothing more than a long spreadsheet. I collect the following information about my trades:

- Number: This is a continuous number of my trades. It can help you to link it to other notes you may collect in a text file or any other application.

- Buy and sell date: Here I write down when I opened the trade and when I close it.

- Duration: I apply an automatic formula to calculate the difference between buy and sell date. It is interesting to make an analysis about the duration of your best/worst trades. The duration of bad trades should be as short as possible.

- Currency: If you trade different currencies, you should write it down. Afterwards you can analyze in which currency you made the best trades. If you trade only one currency, remove this column.

- Instrument: Here I write down the ticket symbol of the stock or instrument.

- Type: Long trade or short trade.

- Number of shares: This is the number of traded shares.

- Entry price: If you have multiple entries, you can write down the average price. It makes sense to collect very single entry price. If you want to make a post analysis of a single trade, you can see exactly where you entered.

- Exit price: Collect the prices where you exited a trade. It can be an average price, too.

- Initial stop-loss: I write down the initial stop-loss price. This can helps to make an analysis if your stop-loss is too far or to close.

- Stop-loss or exit type: Here I write down how I exited the trade. There are some defined parameters: Initial stop-loss, trailing stop-loss, break-out stop-loss, manual. I do not have take-profit targets. If you use take-profits, you can add that category to the list.

- Highest high/lowest low: This is the highest high price (long trade) or lowest low price (short trade) while the trades was open. This information helps you to see if you give back to much profit until your stop-loss level is reached.

- Fee: How much fees took the trade. You can build a sum afterwards or calculate your average fee.

- Risk: This is the amount of risk. Normally it is 1% of my closed capital.

- Risk original: This is the amount of risk in the base currency of the instrument.

- P/L: Here I write down the profit/loss of the single trade in my trading account currency.

- PL/L in R: I always analyze and look at my trades in risk-multiples (R). This helps me to get a different perspective on my trading. It helps to avoid the emotional money perspective, too. Here is how you calculate the risk-multiples: Profits / risk.

- Comment: This is an important column. I write down the reasons for the trade and why I exited it. In addition I write down what should be improved in hindsight.

More helpful information

I experimented a lot with other data and information. If I add a new value to my spreadsheet, I go trough all previous trades and add the information.

For beginners I recommend to collect some more information. It helped me a lot to take screenshots from the entry/exit, important events during the holding period and more textual notes.

In the past I had a big Evernote file about every trade I made and added the checklist of the trade, make notes about my feelings and expectation. As I said: It is extreme helpful for beginners and if you start a new trading system.

But if you trade the same approach for some time, you can leave some informations out. Every trade of the same approach follows the same rules. That’s why I only collect the information above in my spreadsheet today. But if I would start a new trading approach today, I would start to collect much more data about it.

The trading diary: Checklists, emotions, trading actions

Most people know diaries from the childhood or movies. You try to write down what you have done today or how you feel about anything. But if you are an adult, it fulfills another role.

Every professional who tries to change something, should write a diary. Why? Because you reflecting yourself and your actions. Of course it must be done honestly. If you lie at yourself, it can’t help you.

I wrote a trading diary from the first day. It makes perfect sense to my. The diary changed over time and I adjust it sometimes to match new goals.

How you change a behavior with a diary

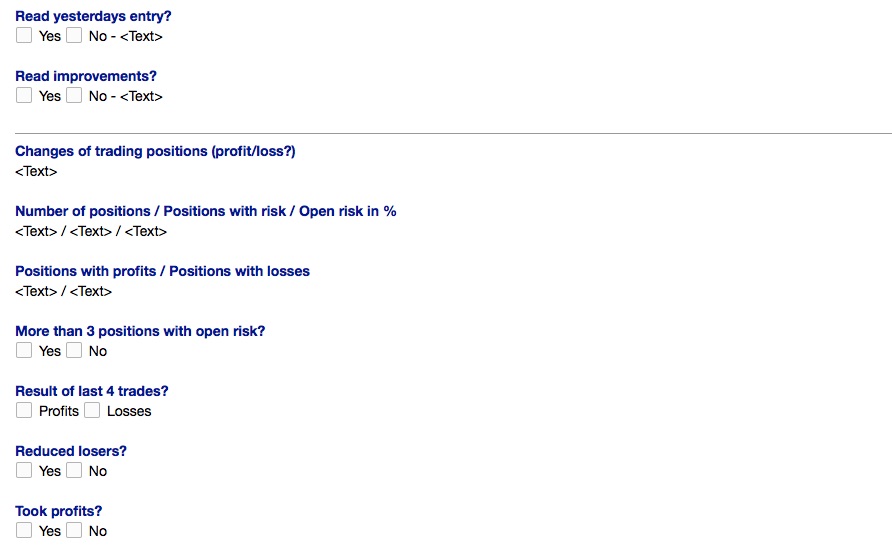

My diary is a mix of checklists and free texts. It is the framework for my daily trading routine and guides me.

The layout of my dairy follows a specific goal. If I want to change a special behavior or want to emphasize a special point in my trading routine, I change the layout and content.

An example: If I want to make sure that I always set every alarm for a potential trade, I add it as a section into the dairy layout (Did you set every alarm potential trades? Yes/No).

Over time the checklists and reflection of your change will help you to change your behavior. It changes the structure of your brain and the new behavior becomes natural. Then you can take the next goal and include it into the daily routine with your diary.

What’s in my trading diary

Here are some elements which are in my trading diary today. But this is my personal diary. You should adjust the layout and content to your goals.

- Did I read the diary entry from yesterday? Yes/No. This is the first question. It helps me to focus on my trading and resume my thoughts from yesterday.

- Did I read the improvement list? Yes/No. I always have points for improvement. These are included into a list which I read everyday to remind myself about it.

- Changes of trading positions. Here I include a screenshot from my current portfolio. It shows the changes of my positions.

- Total positions/Positions with open risk/Open risk in %. I always focus on risk. So I track how many open positions I have and how many of them have open risk. I include the open risk in percentage related to my total capital. Over time you get a good feeling how much open risk you can handle.

- Positions with profit/loss. This is also a mirror of my current portfolio. I track how many positions with a profit or loss I have open. If there are more losers than winners, something is wrong and I maybe have to adjust my portfolio.

- More than x positions with open risk? Yes/No. This is a question I want to remind myself about. I want to make sure that I don’t have to much open risk. The value must vary with your personal risk parameters.

- Results of the last 4 trades. Positive/negative. That question helps me to focus on how my trading is working currently. If my last 4 trades produced a loss, it is a sign that my trading is not working good at the moment.

- Maybe reduced losing positions? Yes/No. This is something were I am working on and implemented new rules. To remind myself about the change and to learn the new behavior I included that question.

- Maybe took profits? Yes/No. Same as the previous question. I want to learn new rules and that’s why included that into my daily routine.

- Adhered to my improvements. Yes/No. Did I recognized and adhered all improvement points? There is usual no “No” to this question. If I violate a point, I write it down what went wrong and why.

- Set all alarms and noted all potential trades? Yes/No. Because I am a part time trader, it is very important that I am prepared for everything. This is why I remind myself about that step in my daily routine.

- Charted my equity curve? Yes/No. This is a reminder to make sure I charted the change of my equity curve.

- Estimation of current market situation. Bullish/neutral/bearish. That question helps me to get a better feeling for the markets. I have no special rules for that. Because I am going trough hundreds of chats per day, I get a good feeling about the market situation. In addition the change of my portfolio is helping me to answer this question.

- Estimation of risk. Aggressive/neutral/conservative. It is an estimation about the risk level I want to have in the current market. This question is linked to the previous one. If the market is not good looking, I want to have only a conservative risk. But if there are several very good setups and stocks making new highs, I want to be aggressive.

- Duration of trading routine in minutes. Over time you get a good feeling about your trading and the market situation with that question. I experienced that if my trading routine was short there is nothing todo and the market is not in a good mode. If my trading routine starts to take more time, the market situation is getting more interesting. It also helps you to limit your time. For me it makes no sense to spend more time with trading as necessary. The opposite is true: The more time I spent, the worse are my results.

- Free text. Mandatory! This is the most important part. I write down everything which came into my head: Feelings, market situations, changes in trades, my behavior … I am very honestly with myself. But be aware: Do not write badly about yourself and your trading. Try to be objective and positively. This should help you to change and improve your confidence in your trading. Everything you wrote down is stored in your brain and your subconsciousness. So be friendly with yourself.

The free text part is the most important part

As I wrote at point 16, the free text part is important. I use them daily in my trading routine. Sometimes I know exactly what I want to write down because it’s in my head before. Then I open my Evernote trading diary and start typing.

It has not to be a lot of text, but it should address the important things of your day. I normally write about a specific trade, the market itself or what I done wrong. But I also include ideas, improvements or sometimes screenshots.

For me it is important that the trading diary should help you to change. If something makes not sense, remove it. It is much more important to have a daily routine then to produce a lot of content. Start small and adjust over time.

The chart and rules book: Your trading plan

Some years ago I was not a big fan of a written out trading plan. Why? Because I thought that I just need all the rules and setups in my head. But that changed …

Today I see my trading plan as a collection of rules and best practices. My thinking is that trading is more a craft than an art or a science. But this is just my thinking and you could have a different view on this.

Collecting charts like game moves

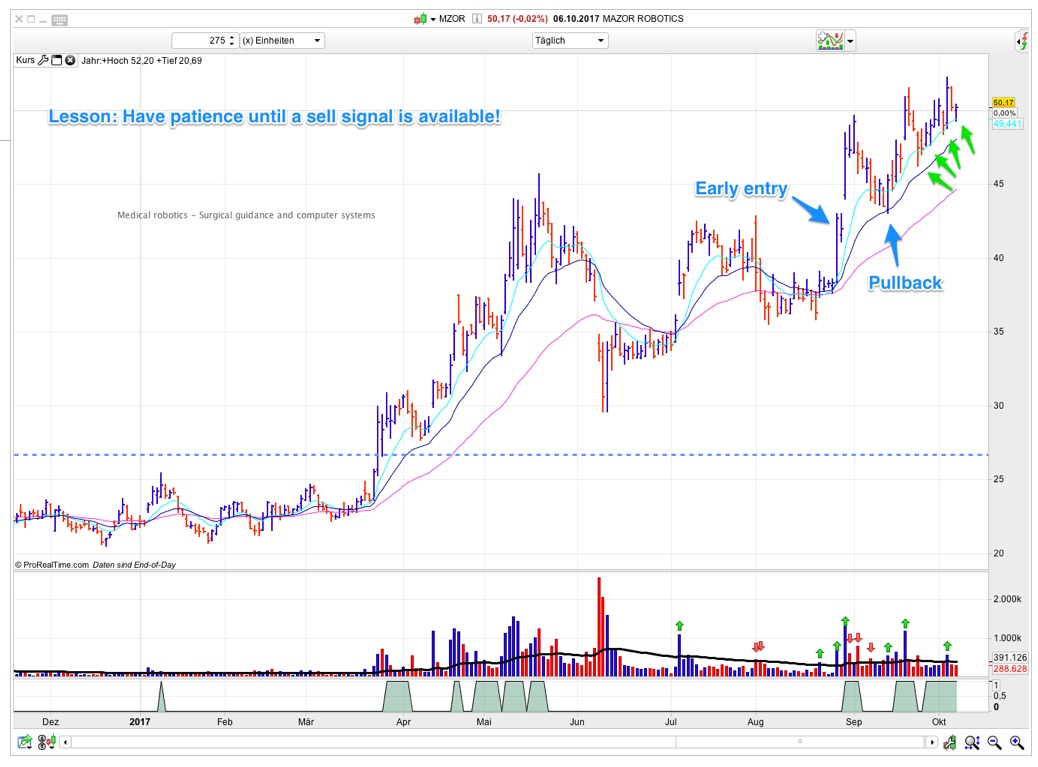

I am a big fan of annotated charts and I collect them in a presentation file (like PowerPoint). It’s like a book where you collect your best moves and analyze what’s behind it.

If I see a good chart (stock or index) I make a screenshot and annotate it with comments. My goal is always to learn something. It could be a missed trade, a real trade I made or good/bad examples.

Sometimes I go trough the file and remove some charts and add new one. This is a living document and I want to make sure that it contains only charts which are matching my rules.

The rules part

Written out rules have an advantage: You can always read them and reflect them.

Especially because I am a discretionary systematic trader, I have a ruleset which guides me in my trading. The ruleset contains rules and best practices about selecting stocks, entry/exit, risk management, position management and market behavior.

I make sure that I regularly recap this document and internalize the rules. Sometimes I learn something new or write down new best practices. It is a living document, too.

Does the document need a lot of pages? No. But I make sure that I always understand the content and know exactly what it means. It’s not a rough collection of text fragments, but it is a file for me. It’s adjusted to my personal style. So if I would give it away, not everybody could understand the content.

Final thoughts

I made the experience that it is essential to find a process which suits you and not everybody else. That means that also your tools matches your personalty and are compatible with you.

Only you can find a way and daily trading routine for you. I just can give examples how I do this. But in the beginning I also adopted routines and tools from other trades. But after a while I drop them. The reason is simple: It was not mine. It was always a torture to work with them. So I develop my own. That was the only thing which worked …

Recommended books

Here is a small list of recommended trading books about this topic.

Last update: 2022-05-20 / affiliate links / Images: Amazon Product Advertising API